Bangladesh entered into the new year 2025 with the enormous expectations of July – August student-led mass uprising and the new interim government lead by chief Adviser Nobel Laureate Prof Muhammad Yunus since 8 August 2024. The country has been facing economic challenges harshly in addition with the political challenges and demands of different deprived of groups. Export earnings and remittance are the two main source of Bangladesh foreign currency in addition to some foreign investments or loans. Amidst in challenges, Bangladesh has recorded its highest ever remittance inflow in December 2024 with USD 2.64 billion, a rise of 32.54 per cent compared to December 2023 and in Bangladesh the previous highest remittance inflow was USD 2.59 billion in July 2020. The exports flowed to USD21.88 billion in total during the July-December period, marking a USD2.74 billion or 12.52 percent rise compared to USD21.88 billion in the previous fiscal’s corresponding period. Due to such a robust flow of export earnings and remittances during the period helps mitigate the crisis of forex reserves and quite stable exchange rate of Bangladesh. On 24 December, the central bank reported a forex reserve of USD24.97 billion. As per the international monetary fund’s (IMF) BPM-6 method, the reserves were USD21.8 billion, up from USD18.6 billion in the previous month. Forex reserves slightly edged up to around $21.4 billion on the last day of 2024, its growth will be eroded if foreign direct investments (FDIs) don’t pick up and upward trend of remittance inflow. Bangladesh has been grappling with a dollar crisis for over two years, with a steady decline in forex reserves. Following the political changeover, the interim government took various measures, leading to a halt in the falling spree. This good growth in remittance came at a time when the country has been hit by persistent dollar crisis. Stakeholders believe such good growth in remittance that a rise in expatriate income might play a major role in addressing this shortage of dollars.

Bangladesh’s interim government is preparing the budget for the Financial Year 2025-2026 which will be declared in June 2025. Government should evaluate very carefully the ongoing real challenges facing by the country and prioritize the issues for the greater interest of the mass people and its durable infrastructural developments. The evaluation is also so important for the ongoing reforms for overall strong economic structure and sustainable economic growth of Bangladesh. Bangladesh will face new year with economic challenges particularly controlling of inflation and unemployment as aspiration of the student lead anti-discrimination movement along with political stability and participatory, free and fair upcoming national election.

Export growth

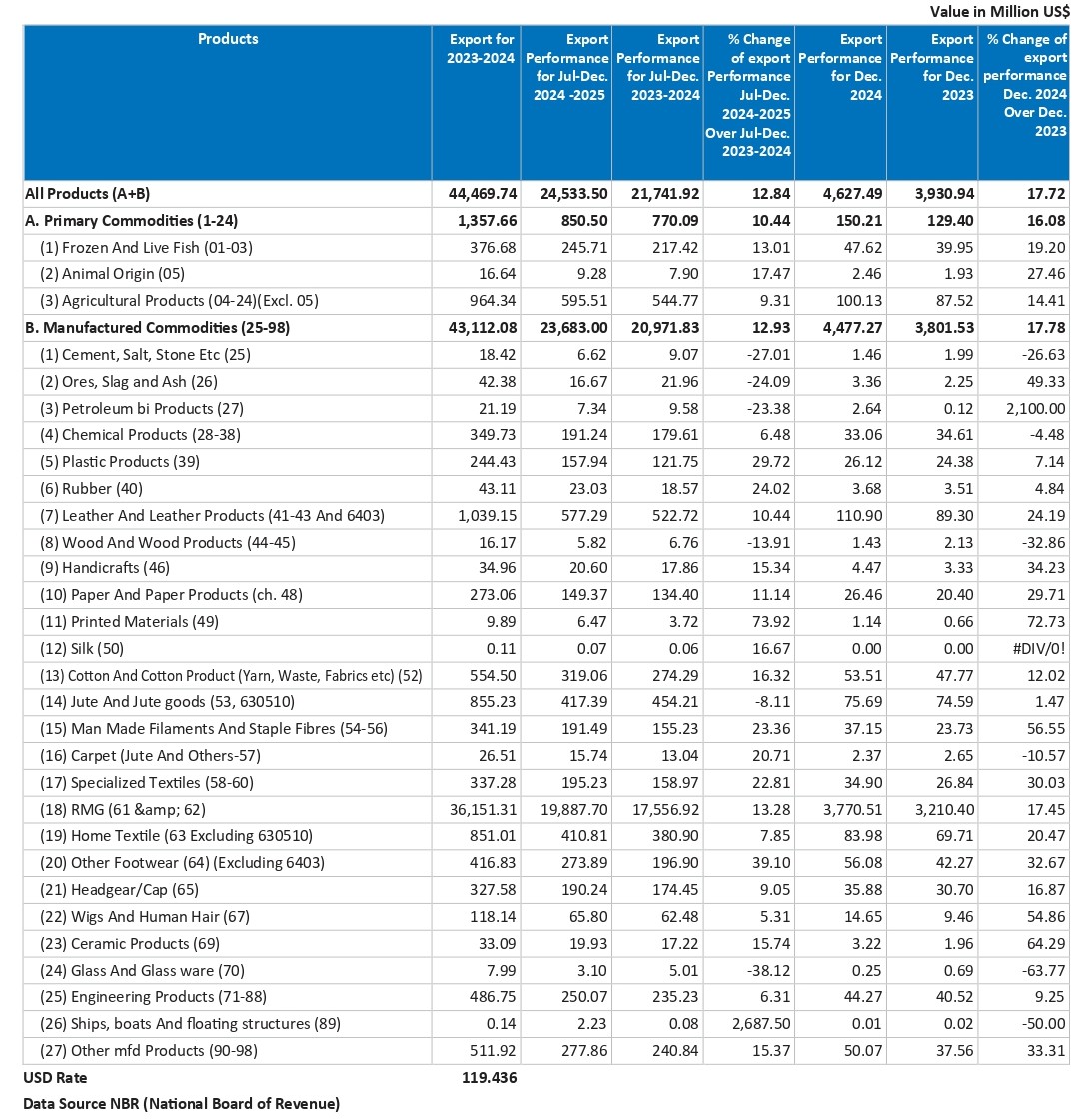

Export is the main source of foreign currency earnings in the Bangladesh economy and export also contributes large number of employment opportunity particularly huge number of female groups. Bangladesh encountered a significant setback in its export growth in the aftermath of the quota reform movement and subsequent developments. The growth, however, bounced back soon after the student-led uprising despite different challenges faced the garments sector. According to the Export Promotion Bureau (EPB), the exports surged to USD24.53 billion in total during the July-December 2024 period, marking a USD2.79 billion or 12.84 per cent rise compared to USD21.74 billion in the previous fiscal’s corresponding period. In 2024, Bangladesh’s exports reached USD50 billion, which was an 8.3% increase year-on-year. This was due to a sharp increase in exports in December alone earned USD4.62 billion, a 17.72 percent increase compared to the same month in the previous year. Bangladesh exports data summary below according to the Export Promotion Bureau (EPB) for the period: Jul-December 2024-2025:

According to the national board of revenue (NBR), in each of the previous three months (October-December 2024), the country exported goods worth more than USD4 billion. Now to continue the increasing trend is going to be a big challenge for Bangladesh as labor unrest, layoffs and scattered closures have been continuing before and after July – August 2024 student-led mass uprising. As well as countries overall law in orders situation, internal tensions in the factory, interruption of supply chain, interruption of transportation, security threat of labor forces, etc. also observed during the period of July-August 2024. So, to continue the export growing trend

and avoiding any negative impact effective measures need to be taken by establishing necessary rights of labor, ensuring security in the industrial areas and safe and secure work environment, establishing good relation among owner, labor and labor union, ensuring good governance and functioning of industrial bodies, uninterrupted supply of utilities and so on.

Remittance growth

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland. Money sent home by migrants competes with international aid as one of the largest financial inflows to developing countries. Workers’ remittances are a significant part of international capital flows, especially with regard to labor-exporting countries. Remittance has been defined by the World Bank as the part of the earnings which a migrant worker sends back to family members in the country of origin.

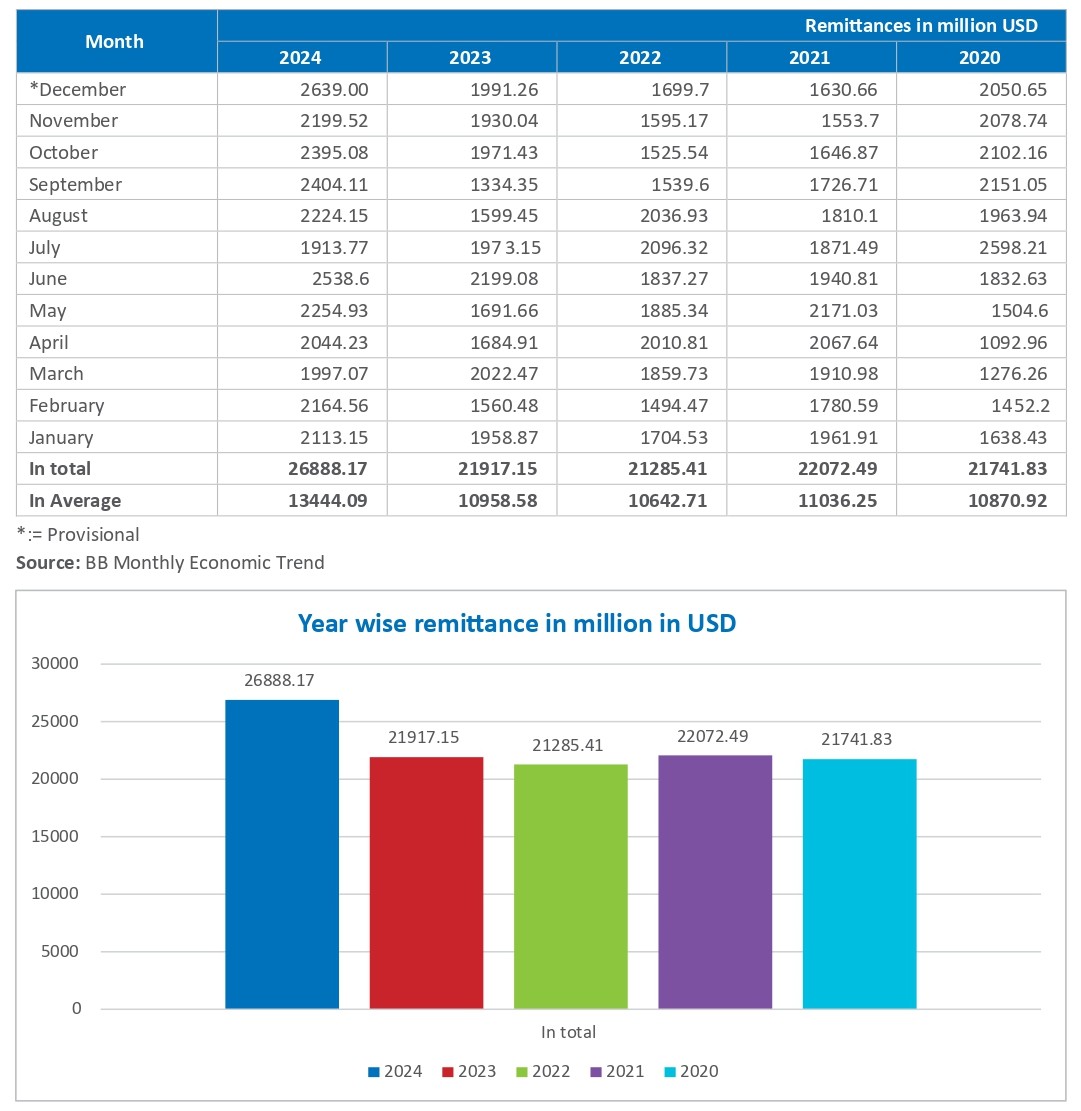

Remittance earnings is the second largest source of foreign currency earnings in Bangladesh. Bangladesh sees highest ever remittance inflow USD in December 2024 USD 2.64 billion, a rise of 32.54 per cent compared to December 2023 and the previous highest remittance inflow was of USD 2.59 billion in July, 2020. In the first half of the fiscal year 2024-25 (July-December), expatriates sent USD13.78 billion in remittances, USD2.98 billion more than the same period last year. During the first half of the previous fiscal year, remittances totaled USD10.8 billion. In recent years remittances are being played significant contribution to forex reserve of Bangladesh which is close to 50% in average of total export earnings though significant attention is not given on remittance as like as attention given for exports earnings. The remittance inflow has been bolstered since the interim government took charge in August 2024. As per BB last 5 years total remittance statistics are shown blow:

As per Bureau of Manpower, Employment and Training (BMET), in 1976 total overseas employment left Bangladesh 6,087 and foreign remittance entered Bangladesh USD 23.71 million which is USD 26888.17 in 2024. The Chief Adviser of Bangladesh’s interim government Prof Muhammad Yunus address to the 79th session of the United Nations General Assembly (UNGA) on 27th September 2024, during speech he mentioned about 15 million Bangladeshi live and work worldwide. In order for migration to be beneficial for all, we have to create pathways for safe, orderly, regular, and responsible migration and mobility of people. The international community has to ensure full respect for human rights and the humane treatment of migrants, regardless of their migration status. While Bangladesh remains committed to the full implementation of the Global Compact on Migration, Bangladesh government is also committed to curve unsafe migration. He also added that about 2.5 million youth people in Bangladesh enter labor market every year.

As remittance by the overseas employees is the second largest source of foreign currency earnings in Bangladesh which is also in growing trend. To boost the remittance inflow and continuing the upward trend in a sustainable manner, a number of measures need to be taken by the government and its related agencies both in short term basis as well as long term basis. Which may include focus on increasing skilled and professional migrant workers, ensuring job seekers with easy access as well as low costs, incentive and post return rehabilitation arrangements after return at home country, continue the incentives for sending remittance through formal banking channel, ensuring extra ordinary level support by the embassy/foreign office staffs as and when requires, reducing the allegations about airport harassment faced by the workers at airports while they travelled to Bangladesh.

Inflation trend concern

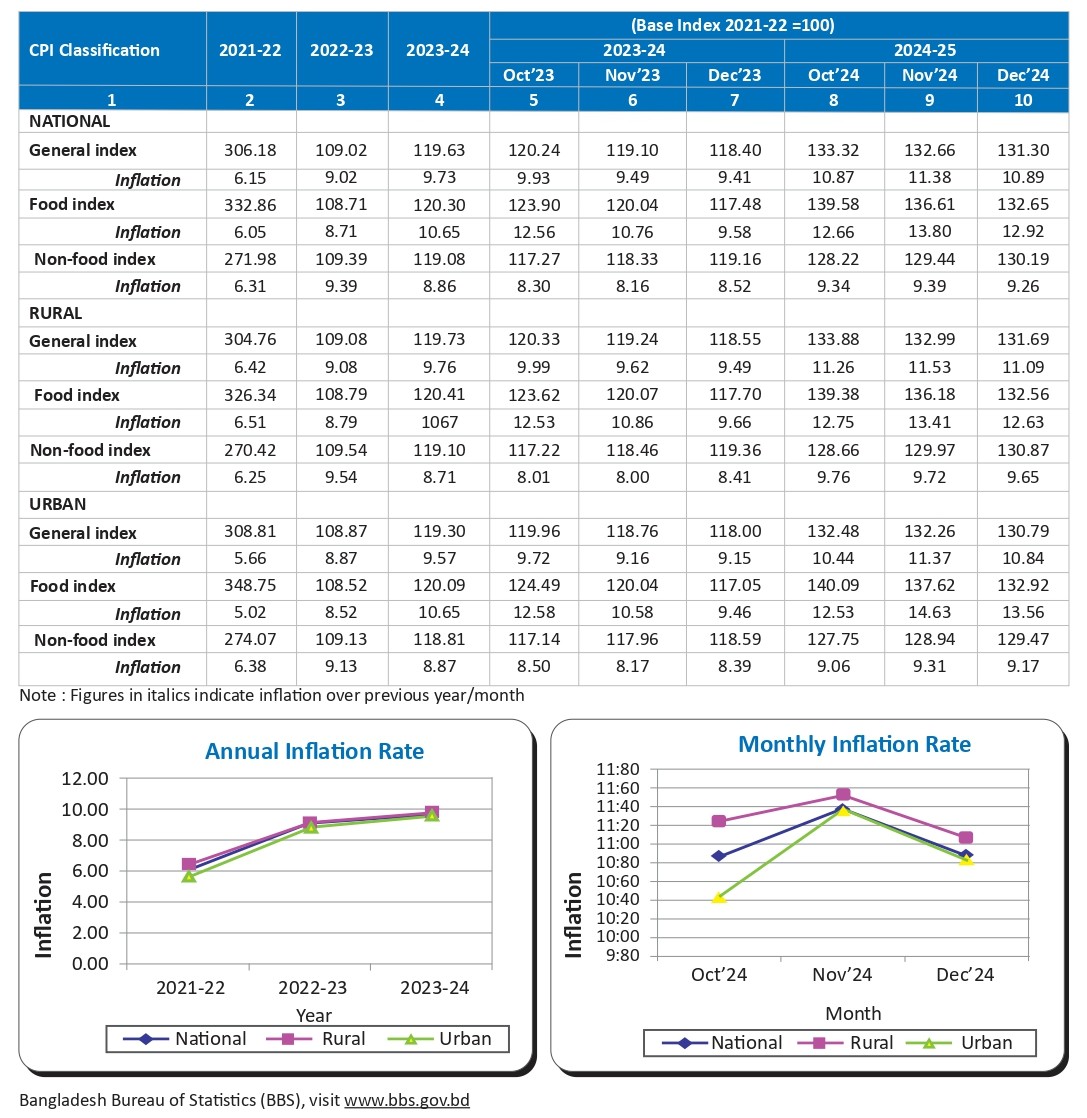

Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. Prices rise, which means that one unit of money buys fewer goods and services. The rate at which purchasing power drops can be reflected in the average price increase of a basket of selected goods and services over some time. This loss of purchasing power impacts the cost of living for the common public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth. An increase in the supply of money is the root of inflation, though this can play out through different mechanisms in the economy. Inflation is the equivalent of a regressive tax on the poor people. It also erodes the buying power particularly the low-income groups. Those with tangible assets, like property or stocked commodities, may like to see some inflation as that raises the value of their assets and stocks. Inflation is one of the major challenges of Bangladesh and its ongoing development phases. Inflation in December 2024 slightly dropped at 10.89, food inflation at 12.92 and non-food inflation at 9.26 comparing to in November 2024 inflation 11.39, food inflation 13.80 and non-food inflation 9.39 according to the latest data published by the Bangladesh Bureau of Statistics (BBS). Inflation could not be tamed even though various initiatives have been taken by the government including tightening monetary policy by Bangladesh Bank for January-June 2024 with a moderated inflation aimed at 7.6% by June FY24. Latest monetary policy by Bangladesh Bank for July-December 2024 aimed to bring down inflation around 6.5 percent at the end of FY25. Annual inflation in the FY 2020-2021 was quite stable below 6 percent, in FY 2021-2022 just over 6 percent but in FY 2022-2023 general inflation climbed at 9.02 percent, in FY 2023-2024 general inflation further climbed at 9.73 percent with a top level at 11.7 percent in July 2024 which was the highest in 12 years.

Printing money without creating real assets can fuel inflation. Bangladesh Bank (BB) the central bank said they will not print money and this step would play a role in controlling inflation. But Bangladesh Bank has extended Tk 22,500 crore as liquidity support to six crisis-hit banks in November 2024 backtracking from their earlier decision.

Demand of some specific import-based essentials are increased remarkably ahead of Ramadan each year whatever the inflation level such as soybean oil, palm oil, dates, chickpeas, yellow peas, pulses. In addition, some other domestic produced and import mix essentials like onion, garlic, ginger, sugar and some other spicy items.

The Ministry of Commerce of Bangladesh is responsible for regulation and implementation of policies applicable to domestic and foreign trade. It has a separate cell in the name of Price Monitoring and Forecasting Cell to ensure the price-level of different essential commodities in a convenient range Price Monitoring and Forecasting Cell was established on 24.11.2014 under revenue budget within the Ministry of Commerce. Comparative analysis of different data on essential commodities such as production, demand, amount of import, stock and supply, domestic and international market price etc. is carried out by the Cell. As part of doing this business, the cell collects information from different organization regarding production, stock, demand, supply, local and international market price, information on LC open and settlement of these essential goods and further works as a helping hand of the Government to keep the market of essential commodity stable by Ministry of Commerce-Price Monitoring and Forecasting Cell.

The Ministry of Commerce of Bangladesh has wing named Trading Corporation of Bangladesh (TCB) having mission Maintain buffer stock of some selected essential commodities to stabilize the market price. Trading Corporation of Bangladesh (TCB) should conduct its activities throughout the year by selling essentials commodities at subsidized prices at different places to ensure relief in some extent the low-income groups.

During the year, import of sufficient essential commodities should be ensured by giving importance all complications of opening LC, sufficient dollars, timely transportation and distribution need to be ensured uninterruptedly. The National Board of Revenue (NBR) should reduce customs tariffs on the imports of such essential commodities helping to ease inflationary pressure on consumers.

Foreign Exchange Reserves

Foreign Exchange Reserves is one of the major economic indicators which has been with a steady declined last few years in Bangladesh. Following the political changeover by July – August 2024 student-led mass uprising, the interim government took various measures, leading to a pause in the falling reserve.

In addition, Bangladesh should work for global context competitive environment and attract the foreign direct investment (FDI) which declined by 8.8% in FY2024. Though FDI is very important for economic development, enhance productive capacity, create employment opportunities, transfer technology and managerial know-how of local labor forces. Government should ensure a sustained socio-political stability, significant policy level and institutional reforms for safe and comfortable movement of Foreign direct investment (FDI) in Bangladesh.

Interest rates was effective a single digit @ 9% since April 2020 and after 31 months the rate withdrawn by the Bangladesh Bank to tame the inflation. In July 2023 introduced the Six-months Moving Average Rate of Treasury bills (SMART) again in May 2024 ending of the SMART is in line with the prescription of the International Monetary Fund (IMF) that has proposed a market-based rate-setting system. Due to insufficient dollar supply and political instability, a large number of companies operated

business in small scale and could not utilized the factory capacity fully during 2024 whereas finance expenses increased significantly as result it became a big concern for the country’s businessmen to recover the losses. Interest rate should set at a moderate level plus minus 10 percent consistent to a realistic business profitability which also may support the business model otherwise production costs will be increased subsequently inflation will raise nonstop and new investment will be discouraged.

Conclusion

Effective reforms are badly needed for sustainable economic and financial growth of Bangladesh. It is very significant to continue the July-December 2024 upward trend of export earnings and records of remittance earnings for sustainable economic growth of Bangladesh and fulfilling the expectation of student-led mass uprising in 2024 which started mainly due to unemployment and inflation. Nurturing the export-oriented industries and services along with diversification plan is so important to continue the raising trend of export earnings, remittance earnings and sustainable infrastructural development of the country. Though export diversification is a multi-faceted concept, which requires multi-dimensional policy guidelines for a wide range of aspects like product diversification, geographical diversification, vertical diversification, quality diversification, intermediate good diversification, and goods-to-services-diversification and so on. Ready-Made-Garments (RMG) sector contributes more or less 80% of total export earnings and Bangladesh yet to reproduce same achievement in other potential sectors as like other countries being made replication such as Vietnam, India, China etc. Beyond the heavily dominated Bangladesh’s export economy of ready-made garments sector, Bangladesh has shown optimistic signs in other industries and services, such as agricultural products, jute and jute products, leather and leather goods, footwear, home textiles, pharmaceuticals, engineering products, furniture, cotton and cotton product, Ships, boats and floating structures, ICT and IT-enabled services. Bangladesh should take sufficient and appropriate preparation as once Bangladesh graduates from Least Developed Country (LDC) status in 2026, it will no longer have access to the duty-free and quota-free regime and simplified rules of origin in the EU market, the main export destination of RMG. The use of Artificial Intelligence (AI), transformation and automation for competitive advantages and low labor costs as well as rapid change of fashion trends should be addressed seriously to fit and competitive with neighboring countries. Global brands are striving to address social and environmental concerns while decide for Foreign Direct Investment and global export. Bangladesh Government should continue the subsidy on fuel and energy sector to reduce production costs and transportation costs which helps controlling inflation and continuing competitiveness in terms of productions costs and new industry establishment to mitigate the unemployment problem and export sustainable economic growth.

Bangladesh is an over populated country with huge labor surplus so new labor market and requirements need to be searched to create the employment opportunities in abroad for skilled, semi-skilled and non-skilled labor. Hence, increasing remittance to the economy. Bangladesh is in 8th position in the list, marking a significant increase and highlighting the continued importance of these financial inflows to the Bangladeshi economy. Bangladesh Government should identify and addressed the accumulated barriers dedicatedly in the sector and give significant attention in this sector targeting on the requirements of manpower importing countries. Since remittance earnings of Bangladesh which represents almost 50% in average of total export, Bangladesh Government should plan to utilize its labor surplus to increase in remittance earnings as well as to advance in the world ranking. Law and security agencies should keep alter in respect of money laundering to boost up and continue the upward trend of remittance inflow through the official channels. All sort of malpractice and irregularities must be addressed and Bangladesh government should show zero tolerance and act to dismantle the exploiting syndicates.

The logistics industry is crucial for our economy to attract domestic and foreign direct investment, which is growing at a high pace. Today investing in a Smart Bangladesh is not just an economic imperative, it is a moral one. A sustainable, better future for all can be built by prioritizing the right budgetary allocations and executions in infrastructure, education, technology, energy and social inclusion.

References:

- Bangladesh Bank (The central bank of Bangladesh)

- Bureau of Manpower, Employment and Training (BMET),

- https://epb.gov.bd/site/view/epb_export_data/-

- https://www.bb.org.bd//pub/monthly/econtrds/

- Ministry of Commerce

- Trading Corporation of Bangladesh (TCB)

- AmCham Bangladesh Journal issue June 2023

- https://www.adb.org/publications/export-diversification-bangladesh

- https://www.thedailystar.net/opinion/views/open-sky/news/what-makes-bangladeshs-economy-more-troubled-progress-3794746

- https://www.tbsnews.net/economy/bangladesh-receives-record-264-billion-remittance-december-1032336