Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. Prices rise, which means that one unit of money buys fewer goods and services. The rate at which purchasing power drops can be reflected in the average price increase of a basket of selected goods and services over some time. This loss of purchasing power impacts the cost of living which ultimately adversely affect the economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

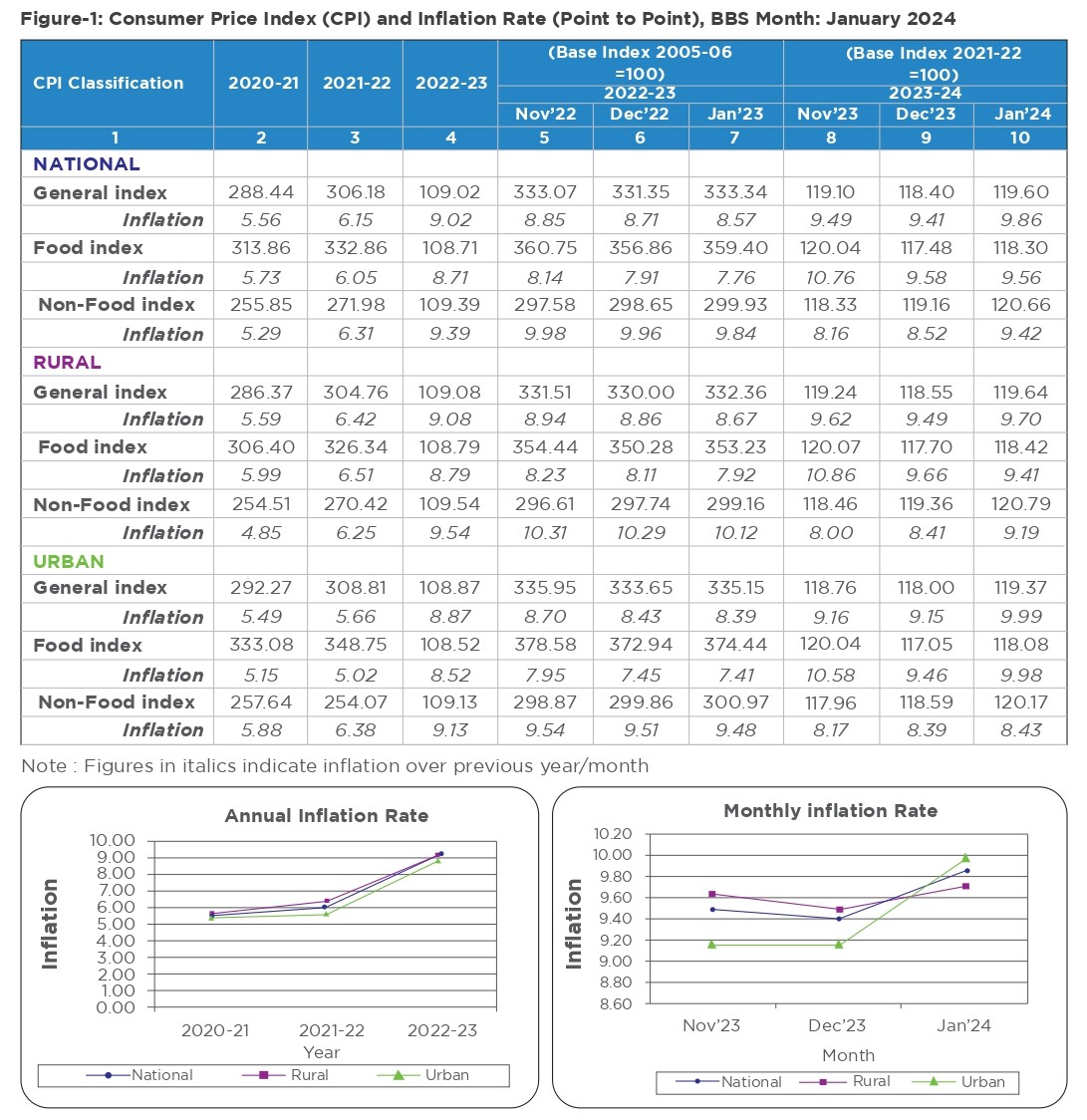

An increase in the supply of money causes inflation, Inflation is the equivalent of a regressive tax on the consumers. It also erodes the buying power enmasse . Those with tangible assets, like property or stocked commodities, are normally reapers of benefits from some inflation as it raises the real & monetary value of their assets and stocks. Inflation is one of the major challenges of development phases in a country like Bangladesh. Inflation in January 2024 jumped at 9.86 percent from 9.41 percent in December 2023 at according to data from Bangladesh Bureau of Statistics (BBS).

However various initiatives have been taken and are ongoing from the government including tightening latest monetary policy by Bangladesh Bank for January-June 2024. A target of inflation to be achieved at 7.5 percent by June FY24 is in book & action. The expected GDP growth target of 6.5 percent in the policy is on record notwithstanding the ongoing development & price spiral challenges . Annual inflation in the FY 2020-2021 was within acceptable rate of less than 6 % and around 6 %. in FY 2021-2022 .However, in FY 2022-2023 it rose to over 9%, & was 9.94 % in May 2023.

General inflation during FY 2023 and January-2024

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a basket of selected goods and services. Bangladesh Bureau of Statistics publishes the monthly Consumer Price Index (CPI) regularly. Throughout the year 2023 inflation showed an upward trend and was volatile starting at 8.57% and ended at 9.41 %. It resulted into adverse grievances for consumers especially of low income-groups.(“Inflation climbs to 12-year high” The Daily Star, July 4, 2023).

By the end of 2023, consumer prices in Bangladesh were in a stable trend which did not sustain the beginning month of the new year 2024.

Food inflation during FY 2023 and January-2024

In January 2024, food inflation slightly declined to 9.56 percent from December 2023 at 9.58 percent. The consumers at large suffer most from food inflation due to squeezed buying power. The period 4 months of August 2023 to October 2023 observed the highest food inflation. The last two months were stable due to various government initiatives like supply of seasonal essential food commodities.

Non-food inflation during FY 2023 and January-2024

Non-food expenditures in education, healthcare, rents, clothing, transportation, entertainment and labor costs take a major share of income of consumers.

Non-food inflation in January 2024 rose to 9.42% from 8.52 % in December 2023.

Remarkably demand of some essential commodities Ahead of Ramadan

Demand of some specific import-based essentials such as soybean oil, palm oil, dates, chickpeas, yellow peas, pulses increase remarkably ahead of Ramadan each year amidst persistent inflation level.

The Ministry of Commerce of Bangladesh is responsible for regulating and implementing the policies applicable to domestic and foreign trade. It has a separate cell in the name of Price Monitoring and Forecasting Cell.

“To ensure the price-level of different essential commodities in a convenient range Price Monitoring and Forecasting Cell was established on 24.11.2014 under revenue budget within the Ministry of Commerce. Comparative analysis of different data on essential commodities such as production, demand, amount of import, stock and supply, domestic and international market price etc. is carried out by the Cell. The cell collects information from different organization regarding production, stock, demand, supply, local and international market price, information on LC openings and settlement thereof pertaining to these essential goods. It further works as a helping hand of the Government to keep the market of essential commodity stable”. Ministry of Commerce-Price Monitoring and Forecasting Cell of The Ministry of Commerce of Bangladesh has a wing named Trading Corporation of Bangladesh (TCB) . Trading Corporation of Bangladesh (TCB) conducts its activities throughout the year by selling essentials commodities at subsidized prices at different places to ensure relief in some extent for the consumers especially from the low-income groups.

Unusual inflationary pressure started since Russia-Ukraine War

Bangladesh kept its inflation rate below 6% during the COVID-19 pandemic periods. The rise in commodity prices arose since February 2022. In fact, the unusual inflationary pressure begins in Bangladesh along with the world after Russia- Ukraine war since February 2022. Russia and Ukraine are major exporters of several commodities such as wheat, natural gas, palladium, nickel, fertilizers, platinum, crude oil, refined aluminum, seed oil, corn. The war has disrupted trade, including global transport routes, and adding distortion in existing supply chains.

“The global trend of elevated prices has seen some moderation primarily attributed to improved supply conditions and stabilized food and energy prices. However, Bangladesh’s economy has yet to experience an equal adjustment primarily due to domestic price rigidity, market imperfections marked by oligopolistic behaviors in certain commodities, and significant depreciation of the domestic currency, counteracting the potential advantages of reduced global prices.” MPS January-June 2023

Controlling Inflation

Price stability or a relatively consistent level of inflation allows businesses to plan for the future to match the expectations. Countries that experience higher rates of growth can absorb higher rates of inflation and for smart Bangladesh the smart control of inflation is very important. Bangladesh’s financial regulator Bangladesh Bank shoulders the important responsibility of keeping stable level of inflation through monetary policy. The policy refers to the determinants of a central bank pertaining to the size and growth rate of money supply.

Bangladesh Bank (BB) issue the Monetary Policy Statement (MPS) half yearly. This policy aims to stabilize and uphold the internal and external value of the Taka (BDT) while concurrently fostering investment, employment opportunities, and overall economic growth.

“The inflexible nature of internal price adjustments, coupled with the persistent depreciation of the domestic currency, might impede a decline in domestic inflation despite recent reductions in international market prices. The inflationary strains and significant price surges observed in various essential goods during FY23 and the initial half of FY24 are likely to contribute to sustained inflationary expectations in the latter half of FY24. Elevated land and construction materials prices have driven up asset prices, further exacerbating inflation risk. While cost-push factors primarily influence inflation in Bangladesh, BB prioritizes measures to curb inflationary pressures. This includes the continuation of tighter monetary policies and strengthened interventions on the supply side, aligning with the objectives outlined in the national budget for FY24. It is anticipated that an improved supply-side scenario, coupled with a stringent monetary policy and support from fiscal measures, will result in a decline in the inflation rate, stabilizing it at an acceptable level by the conclusion of FY24.

BB’s strategic policy initiatives to ease external sector pressures and establish a unified exchange rate regime under a crawling peg system aim to mitigate downward pressure on the Bangladesh Taka (BDT). This strategy seeks to minimize the pass-through effects of BDT depreciation and contain inflation throughout FY24. Additionally, the benefits stemming from BB’s policy-tightening measures throughout the fiscal year are expected to play a pivotal role in curbing inflationary pressures. Considering these factors collectively, achieving the revised target of 7.50 percent inflation by the end of FY24 appears feasible.” MPS January-June 2023

Bangladesh Government should continue the subsidy on fuel and electricity sector to reduce production costs and transportation costs for sustaining efforts of controlling inflation.

Import of sufficient essential commodities should be ensured and giving importance to all intricacies & complicacies of opening LC, sufficient dollars, timely transportation and distribution need to be taken care of for ensuring smooth operation.

References

- Bangladesh Bureau of Statistics (BBS), Consumer Price Index (CPI), Inflation Rate and Wage Rate Index (WRI) in Bangladesh

- https://bbs.portal.gov.bd/

- Monetary Policy Statement, January-June 2024

- mps_h2fy24.pdf (bb.org.bd)

- Ministry of Commerce

- https://mincom.portal.gov.bd/site/page/61ab74fb-84a7-49da-a775-3d23840f7561/Price-Monitoring-Cell

- Trading Corporation of Bangladesh

- https://tcb.gov.bd/site/page/686ef3bc-a0b8-4805-874a-08b1f0181ffe/-

- What you need to know about the purchasing power of money and how it changes

- By JASON FERNANDO, Updated January 16, 2024

- Inflation: What It Is, How It Can Be Controlled, and Extreme Examples (investopedia.com)

- https://www.thedailystar.net/business/economy/news/inflation-climbs-12-year-high-3360391